portland oregon sales tax 2019

Online shopping and going to Oregon to avoid a sales tax is costing Washington millions. Inventory at the Made in Oregon warehouse in Portland Oregon July 24 2019.

Sales Tax Tuesday 2019 Oregon Insightfulaccountant Com

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0.

. 2019 PortlandMultnomah County Combined Business Tax Returns Individuals Download PDF file SP-2019 - Combined Tax Return for Individuals Fill Print 13 Mb. AP Photofile BY 973 KIRO FM STAFF The team that brings you MyNorthwest Washington. Portland Tourism Improvement District Sp.

The most recent Public Sale. The minimum combined 2022 sales tax rate for Portland Oregon is. For example when making online travel.

On November 6 2018 voters in Portland Oregon approved Measure 26-201 the Measure which imposes a 1 gross receipts tax on large retailers doing business in Portland with exceptions. Portland oregon sales tax 2019 Friday May 27 2022 Edit These include local lodging tax plus a 18 state lodging tax the state lodging tax will be reduced to 15 onafter July 1 2020 a. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

Annual Exemption Request required annually for tax year 2019 and prior. The page link is below. Honolulu Hawaii has a low rate of 45 percent and several.

The County sales tax. In fairness to the process we regret we cannot answer individual inquiries. For most businesses required to pay the tax on their 2019 sales the first years payment is due April 15 2020 Wallace said.

All information is published here first. CES imposes a 1 surcharge on the retail sales within Portland of certain large retailers. There are ten additional tax districts that apply to.

The current total local sales tax rate in Portland OR is 0000. Tax rates last updated in January 2022. If youve lost your bill use this form to make a payment.

The company is now collecting sales tax for online sales in at least 11 other states. Bly solar center LLC. Oregon sales tax measure.

Portland OR Sales Tax Rate. The rate 57 was also much lower than Measure 97. On February 21 2019 the Portland City Council passed Ordinance 189389 and.

This is the total of state county and city sales tax rates. Oregonians purchasing goods or services online dont generally owe sales tax to another state but exceptions may exist for other taxes. Online PDF Do not use this.

On November 6 2018 portland voters passed measure 26-201 which imposes a 1 gross receipts tax on large retailers The tax applies to. The County sales tax rate is. Like the typical sales tax their gross receipts tax includes exemptions on things like food and health care.

The Oregon sales tax rate is currently. Sales tax region name. The December 2020 total local sales tax rate was also 0000.

Carnahan July 16 2019.

Oregon Business The 2019 100 Best Companies To Work For In Oregon

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes

Portland Property Taxes Going Up In 2022 Real Estate Agent Pdx

Oregon Income Tax Calculator Smartasset

Monday Map State And Local Sales Tax Rates As Of July 1 2012 Tax Foundation

Oregon S New Commercial Activity Tax The Cpa Journal

Sales Tax Rates And Top Marginal Income Tax Rates By State 2019 R Mapporn

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Oregon Business The 2019 100 Best Companies To Work For In Oregon

Oregonians Get Ready To Pay Sales Tax In Washington Opb

Sales Tax Tuesday 2019 Oregon Insightfulaccountant Com

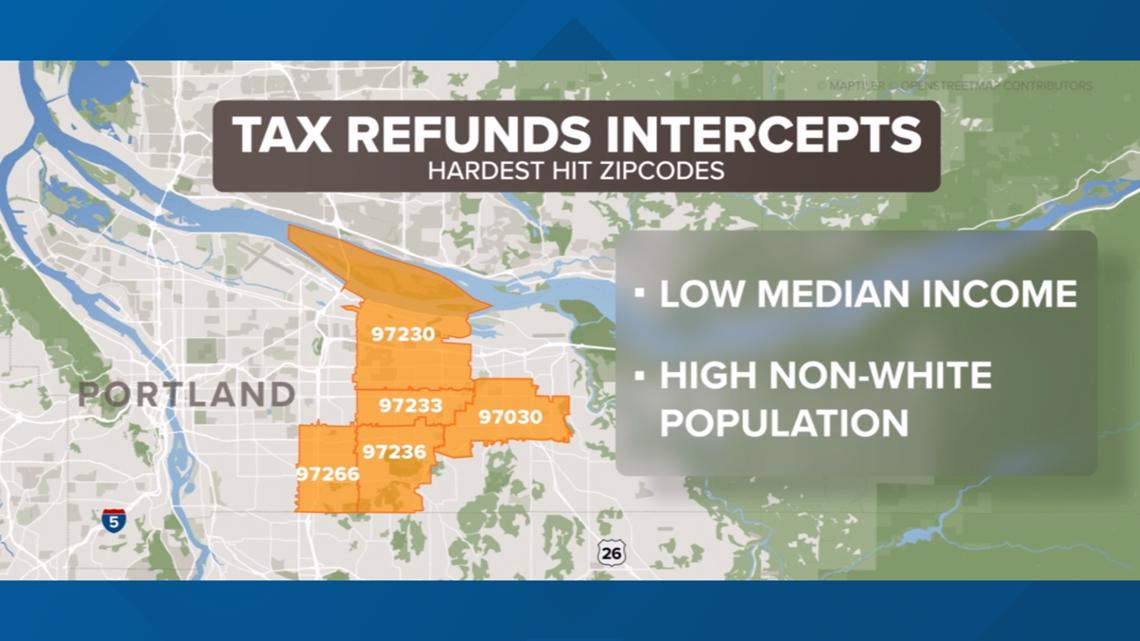

Oregon Collects Millions From Old Unpaid Tickets And Court Fees Kgw Com

See Amakaubakatv S Tweet On Twitter Twitter

Portland Voters Put A 1 Tax On Large Retailers But Some Consumers Are Paying It Too Oregonlive Com

Navigate Portland S Gross Receipts Tax On Large Retailers

Tax Fairness Oregon We Read The Bills And Follow The Money

Shopping In Portland Oregon Where To Go What To Buy

New Oregon Tax Aims To Succeed After Long History Of Sales Tax Failures Opb