why did i get a tax levy

Working With a Tax Professional Attempting to negotiate on your own with the. Before issuing a levy the IRS will go through several key steps.

How Does An Employer Comply With An Irs Wage Levy Wagner Tax Law

This step usually occurs after you file your tax return although if.

. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. A tax levy is the seizure of property to pay taxes owed. A tax levy is a procedure that the IRS and local governments use to collect money that you owe.

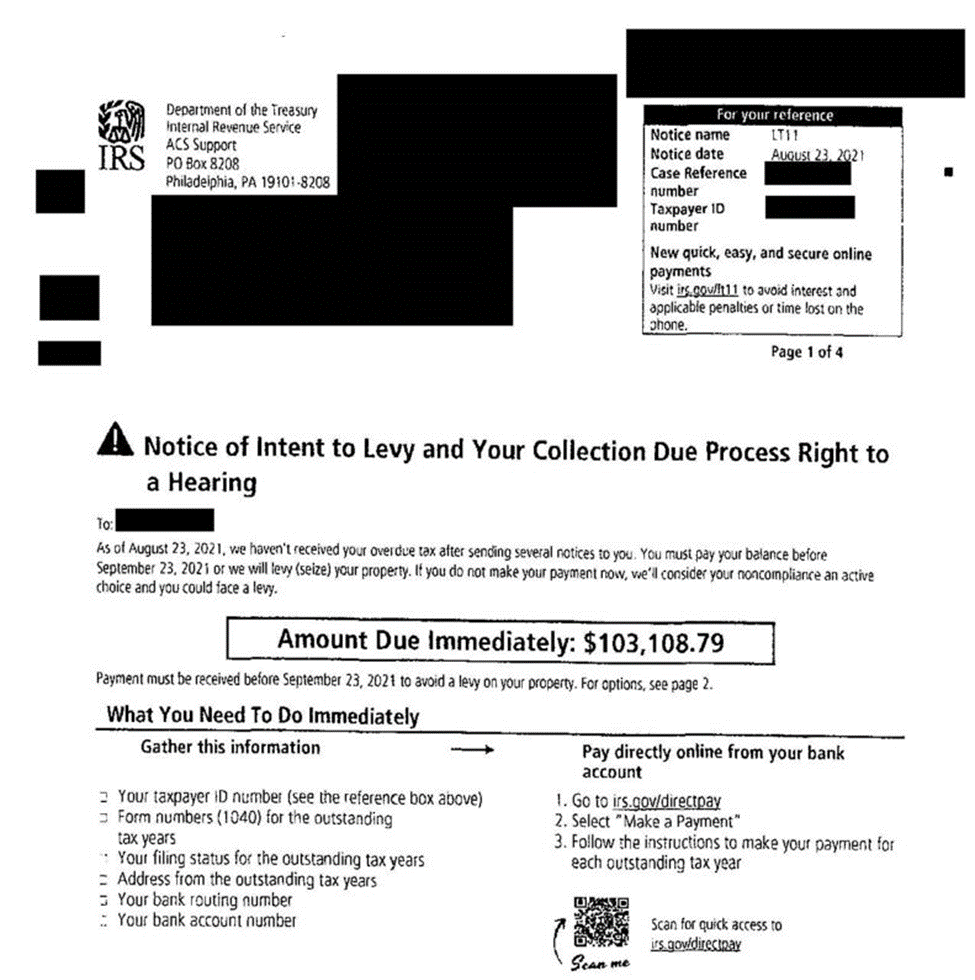

Why Did I Get A Tax Levy. A bank levy can take place for various reasons but you can make the process a bit easier by looking at your tax debts first and foremost. IRS will send you a notice prior to levying the dividend giving.

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes. A tax levy is when the irs takes property or assets to cover an outstanding tax bill. Levies are different from liens.

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as. This notice will explain your. If an IRS Revenue Officer has called you or stopped by your house.

The first is assessing the tax you owe. Why Did I Get A Tax Levy. Why did I get a tax levy.

It is important that the tax liability is resolved as quickly as possible before filing a lien becomes necessary. This information cannot be released to the employer. A levy is a legal seizure of your property to satisfy a tax debt.

A professional tax relief specialist can assist you conserve time money and frustration by informing you upfront on what you need to do to resolve your specific Internal Revenue Service. An IRS levy permits the legal seizure of your property to satisfy a tax debt. IRS Tax Levy Process.

A tax levy is when the irs takes property or assets to cover an. If you do not pay your back tax debt the second step in the bank levy process will occur. If they have written you a letter they want a response.

You may get a reduction or exemption from paying the Medicare levy depending on. Contact the IRS immediately to resolve your tax liability and request a levy release. Tax levies typically show up after the government has placed a tax lien.

To get an updated payoff figure the person who owes the tax liability will need to contact the IRS. Tax levies can collect funds in several different ways including taking funds. The IRS will send you the Final Notice of Intent to Levy.

A tax levy is when the irs takes property or assets to cover an outstanding tax bill. A continuous wage levy may last for. A tax levy is when the irs takes property or assets to cover an.

The most common reason above all. A qualified tax attorney can halt the bank levy process and help you obtain a fair and affordable tax settlement. A tax lien is a claim the.

Will have a negative effect on your credit rating and in most cases. For example if the IRS issued a levy against your wages they would notify your employee. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate.

This program matches federal tax delinquent accounts against a database of Alaskan residents eligible to receive the dividend. The IRS can also release a levy if it determines that the levy is causing an immediate. Yes the IRS wants to hear from you.

A tax levy is when the IRS places a fine on a taxpayers assets or property due to.

Can An Offer In Compromise Stop A Tax Levy Get Tax Help

What Does An Irs Levy Letter Mean Ayar Law Detroit Mi

What Is A Tax Levy And Tax Lien Turbotax Tax Tips Videos

What Is A Tax Levy Understand The Types Process And Purpose

What You Need To Know About Irs Levies Damiens Law Firm

What Is A Tax Levy And How Do You Prevent It Finance Tips Business Accounting Blog

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

What Is A Levy And How To Prevent A Levy

Tax Lien And Tax Levy Global Tax

Irs Collections How To Avoid A Tax Lien Or Tax Levy Landmark Tax Group

How To Get An Irs Tax Levy Released Jackson Hewitt

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

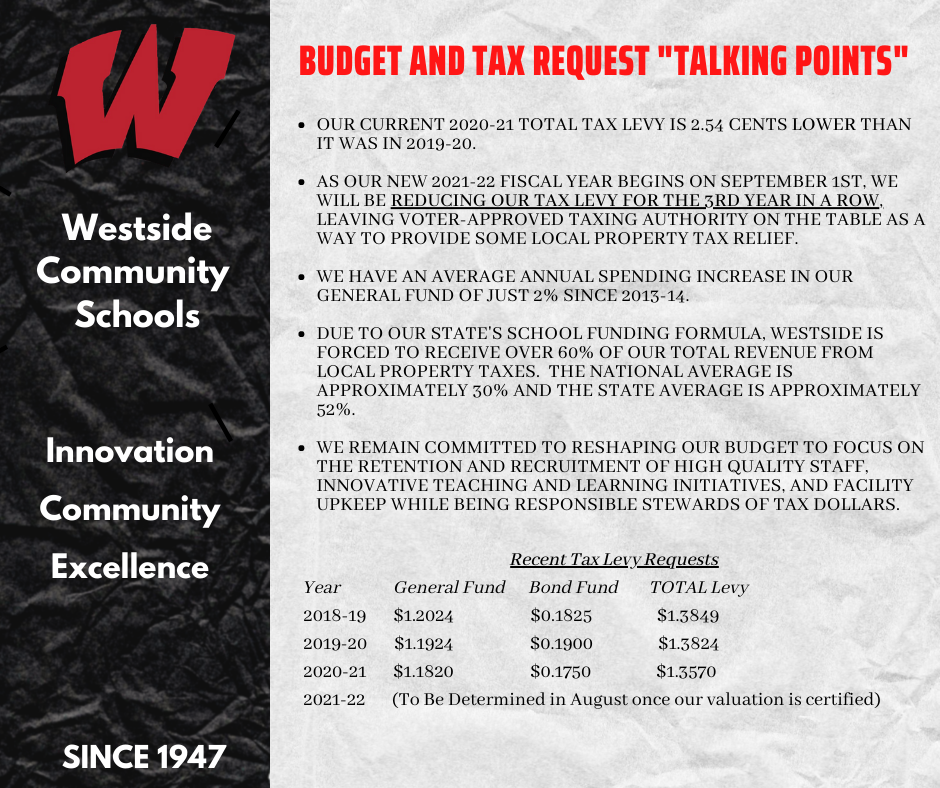

June 25 2021 District Reduces Tax Levy For 3rd Consecutive Year

Proposed Tax Levy Reflects Serious Increase News Presspubs Com

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Tax Levy What Is A Tax Levy And How To Stop One Community Tax